As an international student studying at Arkansas Tech University, it is important for you to know that it is the responsibility of each person in the U.S. to fill out the correct income tax return forms and to report those forms to the U.S. Internal Revenue Service (IRS). These forms tell the IRS what income was earned and how much tax should be paid. You will commonly hear this process being referred to as "filing your taxes."

Income tax forms must be filled out and sent to the IRS on/before April 15, 2026. Students who earned income in 2025 must also report their earnings to the State of Arkansas using form AR1000NR. International students who did not receive wages as an employee will only file tax Form 8843. It is important to note that ALL students must complete a tax form, whether you worked, earned a scholarship, or did not earn any income at all.

Tech has purchased a license agreement that you can use called Sprintax, a tax preparation software designed especially for international students, to prepare your U.S. income tax return. The information provided in this page is intended to serve as a guide for you. Please do not substitute the information below for legal tax advice. It is only meant to assist you in the process of completing your tax forms correctly.

If you DID NOT work OR earn any money (other than bank interest) in 2025, you will need to complete:

FEDERAL FORMS: Forms and instructions are available from the link below

STATE FORMS: No state forms are required to be filed.

If you DID work in 2025 OR if you were taxed on a scholarship or award by Arkansas Tech University or other U.S. entities and received a W-2 or 1042-S form, you will need to complete:

FEDERAL FORMS:

The first 40 students who need to complete a federal income tax form (other than the 8843 alone) will be given a free code to complete the federal taxes on Sprintax. After the 40 codes are used, you can still use Sprintax, but you must pay for the program yourself. Codes are given in-person to students at the tax sessions only and cannot be given via email. Attempting to share your code will result in the revocation of your access to the Sprintax software and the cancellation of your tax filing in the system.

It is possible you will be able to e-file with Sprintax. If so, you will not need to mail the federal tax return. If you do need to mail the form, the software will alert you. If you must mail the tax return, then you will create the forms with the help of Sprintax, print the forms, attach a copy of your W-2, and mail them to:

STATE FORMS:

After filling out the AR 1000NR, print the forms, attaching a copy of your W-2 and the first two pages of your 1040NR, and then mail all documents using the following instructions:

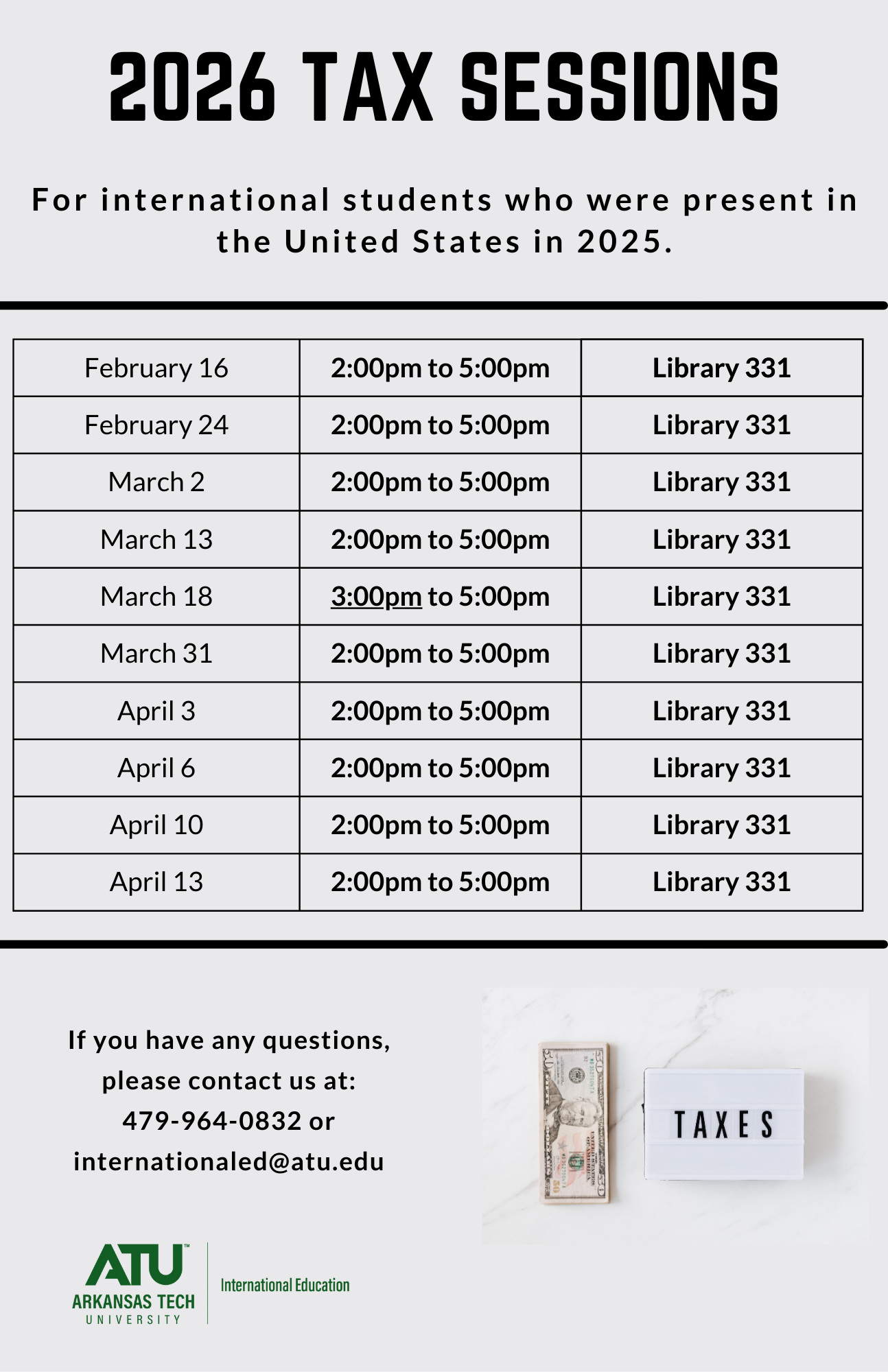

The International Students and Scholars staff will be available to assist you in using Sprintax during a number of scheduled sessions. The schedule for the Tax Prep Sessions is below. For additional help outside of these sessions, please see the Sprintax YouTube channel or register for a Sprintax Webinar.